Case Questions: Prepare your responses to the following the case questions as if you were Sam, the accountant for Wheels of Fortune.

1. Think about your initial observations of the potential causes of the decrease in operating income from 2016 to 2017.

2. Impact on operating income:Calculate the followingto quantify the impact on decrease in operating incoming from 2016 to 2017 for Wheels of Fortune.

a. Standard variable cost and contribution margin per bicycle (percent & dollars): Utilizing the standard cost components and the selling price per bicycle, calculate the standard variable cost and contribution margin per bicycle at standard.

b. Sales mix impact: Analyze the impact of the shift in sales mix by determining the sales mix variancebetween 2016 and 2017.

c. Manufacturing variance impact for 2017 only: Calculate the following:

i. Total direct materials cost variance (price + usage/efficiency). DM price variance = variance between standard and actual * DM used and DM efficiency = excess used * standard cost

ii. Total direct labor (rate & efficiency). DL rate = variance in rate * actual DL hours and DL efficiency = DL std. rate * DL hours variance * # of bikes produced

iii. Total variable overhead variance = OH variance between std. & actual * # of bikes

d. Selling and general administration impact:Calculate and analyze the increase in selling and administration costs on Wheels of Fortune 2017 operating income.

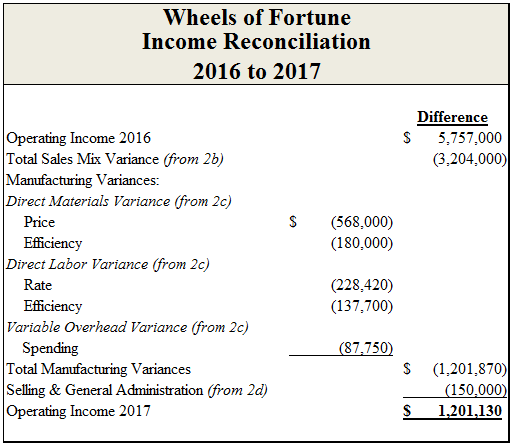

e. Operating income reconciliation: Utilizing the operating income reconciliation from 2016 to 2017, check your calculations from items b-d above for accuracy before completing #2.

3. Recommendations: Based on your financial analysis, generate a professional memo to the partners with your short (less than a year) and long-term (up to five years) recommendations on how to improve the company's operating income integrating information from the schedules you created. A reader with limited financial expertise (e.g. Lance) should be able to comprehend your analysis and associated recommendations.

Information related to above question is enclosed below:

Attachment:- TheWheelsofFortunev9.rar