Problem: At the beginning of 20X2, Dahl Ltd. acquired 8% of the outstanding common shares of Tippy Ltd. for $400,000. This amounted to 80,000 shares.

At the beginning of 20X4, Dahl acquired an additional 270,000 shares of Tippy for $1,512,000. At this acquisition date, Tippy’s shareholders’ equity consisted of the following:

4% non-cumulative preferred shares $1,000,000

Common shares, 1,000,000 outstanding shares 2,400,000

Retained earnings 2,160,000

At this acquisition date, the fair values of the net identifiable assets equalled their carrying values except for the following:

Excess of fair value over carrying value

Inventory $ 96,000

Land 800,000

At the beginning of 20X5, Dahl acquired an additional 450,000 shares of Tippy for 2,880,000. The shares were trading for $6 per share. At this acquisition date, Tippy’s shareholders’ equity consisted of the following:

4% non-cumulative preferred shares $1,000,000

Common shares, 1,000,000 outstanding shares 2,400,000

Retained earnings 2,560,000

At this acquisition date, the fair values of the net identifiable assets equalled their carrying values except for the following:

Excess of fair value over/(under) carrying value

Accounts receivable $W(48,000)

Building and equipment (net) 720,000

Long-term debt 160,000

The building and equipment have an estimated remaining life of 10 years and the long-term debt matures in 10 years.

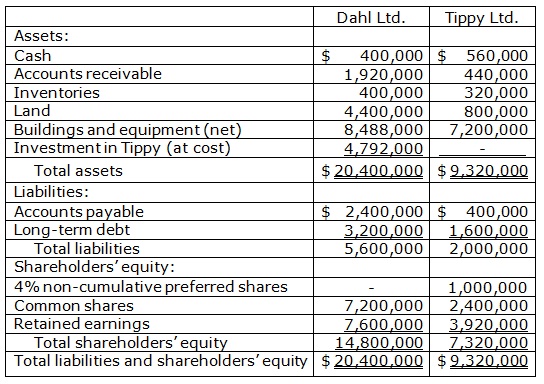

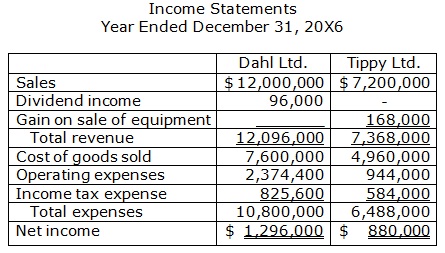

The condensed separate-entity financial statements for December 31, 20X6 are as follows:

Additional information:

a) Dahl and Tippy declared and paid dividends during 20X6 of $400,000 and $160,000, respectively.

b) At the end of 20X5, the inventories of Dahl and Tippy included goods with intercompany profits of $68,000 and $152,000 respectively.

c) During 20X6, Dahl sold goods to Tippy for $3,120,000 at a gross margin of 45%. At the end of 20X6, $200,000 of these goods were still in Tippy’s inventory.

d) During 20X6, Tippy sold goods to Dahl for $2,080,000 at a gross margin of 35%. At the end of the year, $320,000 of these goods were still in Dahl’s inventory.

e) On January 1, 20X6, Tippy sold some equipment to Dahl for $360,000. At that time, the equipment had a book value of $192,000 and an estimated remaining life of 8 years. Dahl has paid Tippy $252,000 and will pay the balance on January 31, 20X7.

f) Both Dahl and Tippy use the straight-line method of amortization for their buildings and equipment.

g) In 20X5, a goodwill impairment of $73,600 was recognized and a further impairment of $46,400 occurred in 20X6. Impairment losses are allocated 80% to Dahl and 20% to the non-controlling interest.

g) Both companies are taxed at an average rate of 40%.

Required:

find out Dahl’s 20X6 consolidated net income and identify the amount attributable to Dahl’s shareholders and to the non-controlling interest. Be sure to show all your computations. You are not needed to prepare a consolidated income statement.