problem1)

Timbatown Pty Ltd is a manufacturer of timber tables and chairs. The company mostly sells on a retail basis to household consumers, but occasionally receives large orders for tables and chairs from schools and businesses. Management uses the first-in-first-out inventory assumption, despite the inventory cost being fairly stable throughout the year. As each item is manufactured, it is stamped underneath with a batch number and cost code. Information about inventory for the past month is presented below:

In stock at 1 June 2012:

26 tables Costs: Materials $440* per table

Labour: $197 per table

Overheads: $66* per table

94 chairs Costs: Materials $110* per chair

Labour: $112 per chair

Overheads: $22* per chair

During June 2012, the following tables and chairs were produced:

35 tables Costs: Materials $396* per table

Labour: $197 per table

Overheads: $66* per table

116 chairs Costs: Materials $99* per chair

Labour: $112 per chair

Overheads: $22* per chair

*Costs associated with manufacture are GST inclusive.

The following sales were recorded during June 2012:

40 tables @ $990 each (GST inclusive)

120 chairs @ $330 each (GST inclusive)

A stock-take on 30 June 2012 revealed that two tables and eight chairs were scratched. Their selling price would need to be reduced to $660 and $165 respectively (GST inclusive). All other items in stock would be sold at the retail price charged during June. The business has a special offer where free delivery is included with each sale. The standard delivery cost is $22 per item (GST inclusive).

Required:

(a) Prepare a partial income statement for June (down to gross profit). Show all workings.

(b) Prepare the general journal entry(ies) to record any inventory prepare down.

(c) Determine the value of each type of inventory at 30 June 2012 in accordance with AASB 102 Inventories. Justify all parts of your answer and show calculations.

(d) Timbatown Pty Ltd uses the first-in-first-out assumption for its inventory. Comment on whether you think the alternative approaches of specific identification or average cost could be used by Timbatown Pty Ltd instead of first-in-first-out.

problem2)

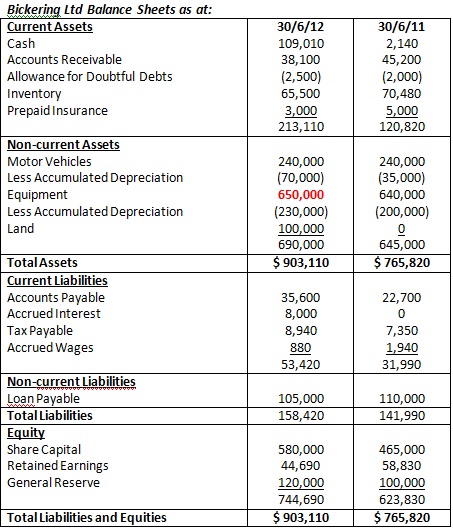

Bickering Ltd Income Statement for the year ended 30 June 2012

Sales (credit) 636,100

LESS Cost of sales (411,500)

GROSS PROFIT 224,600

Inventory Loss (2,200)

Adjusted Gross Profit 222,400

LESS Operating expenses

Depreciation of equipment 50,000

Depreciation of motor vehicles 35,000

Doubtful debts 4,000

Interest expense 11,500

Wages expense 71,300

Insurance expense 12,000

Other expenses 8,800 (192,600)

NET PROFIT BEFORE TAX 29,800

LESS Company tax expense (8,940)

PROFIT AFTER TAX $ 20,860

Other information:

Bad debts were written off during the year.

Equipment was sold for $10,000 cash.

New equipment was purchased for cash.

A loan repayment was made.

Additional shares were issued.

$20,000 was transferred to the general reserve from retained earnings.

Cash dividends were paid.

Tax was paid.

Required:

(a) Prepare a statement of cash flows for the year ending 30 June 2012.

(b) Prepare a reconciliation of profit to net cash flow from operating activities.

(c) Comment on the cash flows of Bickering Ltd. Maximum 200 words. Referencing is not required. A word count is required.

problem3)

B & B Mechanical Repairs is a small, family owned partnership that specialises in the servicing and repair of motor vehicles. The business employs three qualified mechanics, while the partners (owners) spend around half of their time in the office in an administration role, and the other half working on vehicles.

The mechanics repair all makes and models of cars, and order parts from suppliers once a vehicle has been initially inspected. The business could receive as many as 10 deliveries per day of spare parts, each arriving on credit with 30 day terms being offered. Suppliers represent the major car manufacturers including Holden, Ford, Toyota, Mitsubishi, Kia, Subaru etc. At the end of each month, the business receives an invoice from each supplier with the total amount outstanding from the months’ purchases. The invoices are always paid in full within the discount period (if offered).

Customers are required to pay by cash, eftpos, direct debit or cheque on collection of their vehicle, as no credit terms are offered. Other typical transactions include payment of rent each week, the cash purchase of kitchen and office supplies, and the quarterly utilities accounts. The employees are paid in cash weekly and the partners usually take cash drawings of between $900 and $1,200 per week, depending on the week’s revenue.

At present, the business uses one general journal in conjunction with a general ledger to record all business transactions. The business is registered for GST.

Required:

(a) Design templates of special journals that you recommend to be used by B & B Mechanical Repairs based on the information above.

(b) prepare a report describeing to the partners how the introduction and use of the special journals you designed in part (a), along with subsidiary ledgers and control accounts, could be used by the business to improve the recording process. Based on the templates you prepared in part (a), you should also describe in detail when and how posting to the ledgers is done. Use specific exs from the business described above. Maximum 500 words.