Assignment

These questions are based on litigation consulting case interviews.

QUSTION 1:

Your client is Alaska Seafood, which processes seafood in Alaska. It has a 70% market share in the Alaska seafood processing industry. The Halibut, Salmon, trout, other fish, crabs, etc are caught by local fishermen in Alaska, sold to Alaska Seafood, processed by Alaska Seafood, and sold by Alaska Seafood to supermarkets in Alaska in other states, who then sell the food to consumers. Alaska Seafood is being sued by the local salmon fishermen (who only catch salmon and sell salmon to Alaska Seafood). They are saying that over the last 20 years, during which Alaska Seafood has increased its market share from 15% to 70%, it has decreased the price per pound (lb) of salmon that it pays the salmon fishermen. The salmon fishermen argue that this is because of their large market share, which now enables them to charge monopsony prices. You argue that the prices Alaska Seafood is charging are notmonopsony prices; instead, they are fair prices.

a. What is the profit equation? (Hint: Profits = _______ - ________)

b. What would enable Alaska Seafood to expand and increase its profit per unit? (HINT: I'm looking for a very specific economics term, ______ _______ equals to ________)

c. To defend Alaska Seafood, you look at the wages of salmon fishermen in the state of Washington, where the seafood processing industry is more competitive. To defend your client, do you hope to find that the Washington salmon fishermen are paid similar wages or different wages? Explain.

d. Assume that the "demand for salmon" is too narrow of a market definition and that there is a broader "demand for fish." How would an increase in the supply of Russian trout in the global market affect the US market price of salmon? How would it affect the price Alaska Seafood is willing to pay its fishermen?

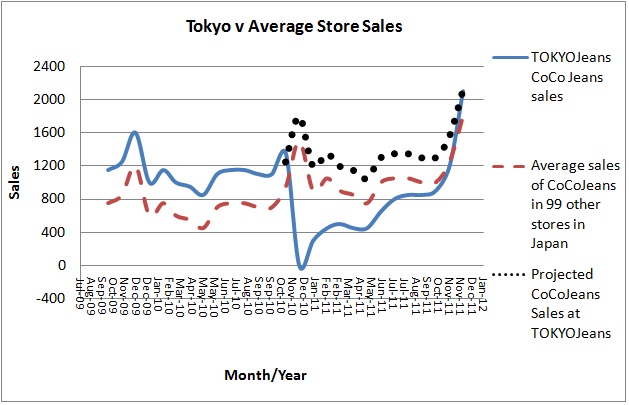

QUESTION 2: Your client is CoCoJeans, a brand of jeans in Japan. CoCoJeans sells its jeans to other stores, such as Forever21, H&M, and boutique stores. There is only 1 store in the city of Tokyo that sells CoCoJeans. There are 99 other stores in other cities in Japan that sell CoCoJeans. The manager of TOJ, the 1 store in Tokyo that sells CoCoJeans, is angry with its CoCoJeans liaison for personal reasons and decides to remove all CoCoJeans for the month of December 2010. This is against the contract agreement that CoCoJeans has with TOJ.CoCoJeans sues TOKYOJeans for lost profits. Use the graph below to answer the following questions:

a. How can you tell that TOJ stopped sales in Dec 2010?

b. Tokyo consumers' view of CoCoJeans was affected by the brand's lack of availability in December. How is this effect illustrated by the graph? How long did it take Tokyo consumers to "forgive" CoCoJeans?

c. Given only this graph, how would you express the amount of damages that CoCoJeans should sue for?

d. It is January 2012 when you are putting together your expert testimony. While researching the market trends, you notice that the sale of jeans (of any brand) increased more than earlier forecasts predicted during summer and fall 2011 because of unexpected economic prosperity. Is it possible that CoCoJeans forecast in November 2010 would have failed to account for this? What type of regression should you do to update the forecast? How should the damages be updated?

QUESTION 3:

a. You're in a 30 story building with 2 elevators. You enter one elevator and Professor Dubin enters another elevator. You do not know which floor you are each going to. What is the probability that you end up on the same floor?

b. You roll 2 fair 6-sided dice. What is the probability that you get doubles (what is the probability that the numbers on both dice are the same)?