Assignment

Question 1: Consider a model in which a buyer seeks to purchase a fixed quantity of a product over two periods: period 1 and period 2. Let the value of the transaction in period 1 be v and let the present value of the transaction in period 2 be δv, where 0 < δ < 1 is the buyer's discount factor. Suppose that the buyer has found a seller who is located overseas and has signed a contract that stipulates the the quantity of the product that needs to be provided to the buyer and the total value of the transaction in each period. The contract between the buyer and the seller stipulates that the buyer has the option of canceling the contract in period 2 if the products provided in period 1 are of low quality. This is because the buyer knows that due to the seller's inexperience, the sellers ability to provide products in period 1 that are of high quality is subject to risk. If the shipment in period 1 is of high quality, then the seller will receive v in period 1 and δv in period 2.

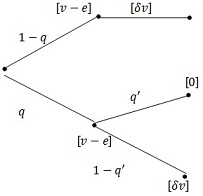

However, suppose that with probability q, the seller provides a low-quality shipment in period 1. In this case, the seller will still receive v in period 1. However, this will cause the seller to face a probability q 0 of its contract being canceled in period 2. If this contract is canceled, then its payoff in period 2 will be 0. If the contract is not canceled, then the seller will continue to receive δv in period 2. For simplicity, you can assume that any risk of providing a low-quality shipment will only occur in period 1. That is, there is no such risk in period 2. The structure of the seller's payoffs in this model are illustrated in Figure 1 below where the terms in the square brackets represent the present value of payoffs in each scenario.

Suppose that the seller has the option of investing resources to lower the probability of it producing a low-quality shipment. In particular, the seller can invest in training its workers or engage in other quality-control processes. Let the amount spent on such quality control be e ≥ 1. Further, assume that an increase in e lowers q according to the following function

q(e) = 1 e (1)

Given that there is no risk of producing a low-quality shipment in period 2, the sellers optimal value of e in period 2 is zero. Lastly, you can assume that the seller is risk neutral and has the following utility function:

u = w (2)

where w represents a payoff.

(a) Write down an expression for the seller's expected utility from supplying this product to the buyer. Use this to solve for the expected utility maximizing value of e. Let this optimal value of e be e1.

(b) Show that for finite values of v, e1 above does not lead to a value of q that is equal to zero. Use a diagram to illustrate the cost and benefit of greater expenditure on quality control to provide some economic intuition for this result.

Now suppose that the seller's government would like to protect the seller from the cost of a contract cancellation. The government's motivation is to encourage its firms to engage in more of such cross-border transactions by insuring the seller against the downside risk. To implement this, the government has agreed to provide the seller with a payout of v in period 2 if its contract is canceled. However, it will charge a premium, m, to recoup its payout costs. Assume that this premium must only be paid in period 1.

(c) To create an incentive for the seller to enhance its quality-control spending, this premium will equal the actuarially fair premium plus an additional charge equal to kq(e), where k > 0 is a constant. Write down an expression for this premium.

(d) Redraw Figure 1 here and update the payoffs to account for this insurance policy.1 Use this figure to write down an expression for the seller's expected utility with this insurance policy. Solve for the new expected utility maximizing value of e, e2. Is the new optimal value of e greater than or less than e1? From part (d) onwards you can assume that q 0 = 0.625, δ = 0.8, and v = 4.

(e) Will the seller prefer the insurance policy equilibrium in (d) or the equilibrium in (a)? Explain.

An alternate way for the government to encourage greater spending on quality control is to reward the seller for providing a high-quality shipment in period 1. That is, suppose that the government decides to cancel its insurance offer and replace it with a prize of x > 0 in period 2 if the seller is able to produce a high-quality shipment in period 1.

(f) Write down an expression for the seller's expected utility with this prize. Solve for the new expected utility maximizing value of e, e3. Is the new optimal value of e greater than or less than e1? You can continue to assume that q 0 = 0.625, δ = 0.8, and v = 4.

Consider the three scenarios described above. These are (i) the no policy scenario in part (a), (ii) the insurance policy scenario in part (d), and (iii) the prize scenario in part (f).

(g) Suppose that the seller only cares about its expected utility in each scenario while the government only cares about the probability that a high-quality shipment is provided in period 1. Use this to rank the three scenarios from the perspective of the seller as well as the government. You can now assume that k = 0.25 and x = 2.5. When reporting solutions below, you only need to show values up to two decimal places.