Assignment

a)

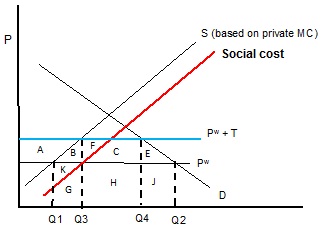

Suppose that a country imports a good but that domestic production includes a positive production externality. The initial situation is depicted above where PW refers to world price. Please put your answer in the answer sheet at the end of this document. Please just identify the areas.

a) Production with no government intervention.

b) Consumption with no government intervention.

c) Optimal production (i.e. where the social marginal cost = price)

d) Total private variable cost of increasing output to the socially optimal level of production from the amount identified in answer a). [Note this is the increase in total private variable cost.]

e) Total social variable cost of increasing output to the socially optimal level of production from the amount identified in part a).

f) Deadweight loss associated with not producing the optimal amount.

g) The domestic deadweight loss if a tariff is imposed equal to "T" in the graph above,

h) If a tariff is imposed equal to "T" in the graph above, welfare will increase if __________ exceeds________.

i) Domestic efficiency gain if a production subsidy is imposed equal to the difference between private and social cost.

2. The basic Ricardian model assumptions apply (i.e. CRTS production functions, perfect competition, immobile labor internationally, labor as only input).

Suppose that the unit labor coefficients for the American and China are:

America aLX = 20L/x and aLY = 2L/Y

China cLX = 50L/x and cLy = 50L/y

Labor endowments

America: 100L China 100L

a. What is the opportunity cost of x in America? (Be sure to include units, i.e. y/x or x/y)

b. What is the opportunity cost of x in China? (Be sure to include units, i.e. y/x or x/y)

c. What is the opportunity cost of y in America? (Be sure to include units, i.e. y/x or x/y)

d. What is the opportunity cost of y in China? (Be sure to include units, i.e. y/x or x/y)

e. What is the maximum amount of X that can be produced in China?

f. What is the maximum amount of X that can be produced in the U.S.?

g. Which country has the comparative advantage in x?

h. Which country has the comparative advantage in y?

i. Which country has the absolute advantage in x?

k. Which country has the absolute advantage in y?