Assignment

1. You are planning to purchase your first home five years from today. The required down payment will be $50,000. You currently have $20,000, but you plan to contribute $500 each quarter to a special savings account until you purchase the home. To achieve your goal, what nominal interest rate, compounded continuously, must you earn on your account? The $20,000 you currently have are not in this savings account.

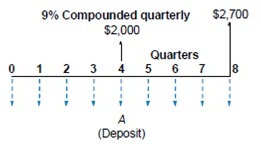

2. What is the amount of the quarterly deposits A such that you will be able to withdraw the amounts shown in the cash flow diagram if the interest rate is 9% compounded quarterly?

a. The amount of the quarterly deposits A should be $?

3. A man is planning to retire in 25 years. He wishes to deposit a regular amount every three months until he retires, so that, beginning one year following his retirement, he will receive annual payments of $80,000 for the next 15 years. How much must he deposit if the interest rate is 6% compounded quarterly?

a. The required amount of deposit is $

4. A married couple are trying to finance their three-year-old son's college education. Money can be deposited at 10% compounded quarterly. What end-of-quarter deposit must be made from the son's 3rd birthday to his 18th birthday to provide $50,000 on each birthday from the 18thto the 21st? (Note that the first deposit comes three months after his 3rdbirthday and the last deposit is made on the date of the first withdrawal.)

a. The amount of the quarterly deposits should be $?

5. Jenny Walters, who owns a real estate agency, bought an old house to use as her business office. She found that the ceiling was poorly insulated and that the heat loss could be cut significantly if six inches of foam insulation were installed. She estimated that with the insulation, she could cut the heating bill by $80 per month and the air-conditioning cost by $70 per month. Assuming that the summer season is three months (June, July, and August) of the year and that the winter season is another three months (December, January, and February) of the year, how much can Jenny spend on insulation if she expects to keep the property for five years? Assume that neither heating nor air-conditioning would be required during the fall and spring seasons. If she decides to install the insulation, it will be done at the beginning of May. Jenny's interest rate is 6% compounded monthly.

a. The maximum amount Jenny should spend on insulation is $?

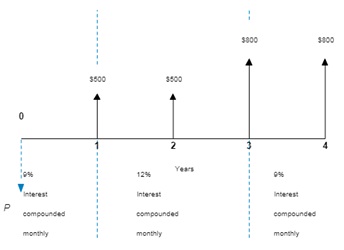

6. Consider the cash flow transactions depicted in the accompanying cash flow diagram with the changing interest rates specified.

(a) What is the equivalent present worth? (In other words, how much do you have to deposit now so that you can withdraw $500 at the end of year 1, $500 at the end of year 2, $800 at the end of year 3, and $800 at the end of year 4?)

a. The equivalent present worth is $?