Assignment

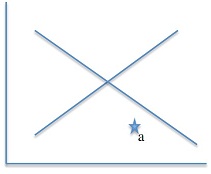

1. Swan diagram

Name all the axes and lines (specify which balance these lines correspond to). The economy is in a: show on the graph how a policy maker can bring the economy back to its internal and external balance.

What is the situation in a in _______ terms of its internal and external balance.

Internal balance:

External balance:

What policy mix will be used?

2. Problems - open economy model - 2 large countries A and B

A's economy is characterized by the following equations.

C = 30 + .8(Y-T)

I = 20

G = 20

T = 20

X = 10 + .2 Y*

IM = 10 + .2 Y

B's economy is symmetrical (replace the variables without star by variables with stars and vice-versa)

Set up the equilibrium relation for each country in the YY* space

i.e. Y = f(Y*) as equation 1 and Y* = f'(Y) as equation 2

Y = ____________ (1)

Y*= ____________ (2)

Solve the system of equations to derive the joint equilibrium values of Y and Y*

Y = ________

Y*= ________

Show the 2 relations (1) and (2) on the graph below and report the joint equilibrium

- show the values of the intercepts and slopes.

Now assume that country B raises tax: show the impact on the graph.

Will equilibrium Y increase or stay the same or decrease

Will equilibrium Y* increase or stay the same or decrease

Y and Y* were originally equal since the model was symmetrical. What can you say now about the new equilibria Y' and Y*':

is Y'>Y*' or Y'=Y*' or Y'

Give all your exchange rate answers with 6 digits

3. Cross exchange rates calculation - Australian dollar/Euro/pound.

On October 19, 2017, the spot exchange rate between the Aus$ and the pound was Aus$ 1.669374/£ and the spot exchange rate between the Aus$ and the euro Aus$1.504315/€. Calculate the exchange rate between the euro and the pound as quoted in France (i.e. # of euro per pound).

4. Spot and forward exchange rates

Use the data from a table entitled Currencies included in the larger table entitled FT World Markets at a Glance (Sept 29, 2017) given to you at the beginning of the year (also available in the course web page) to answer the following questions. Find the forward exchange rate (1 month) between the $ and the British Pound and the forward exchange rate (1 month) between the dollar and the euro in the table as well as the spot exchange rates (closing mid point).

a. Report below:

Spot $/£ = 1 month forward $/£=

Are the markets expecting the Pound to depreciate or to appreciate with respect to the dollar? (underline the correct answer)

b. Report below:

Spot $/€ = ___________ 1 month days forward $/€=

Are the markets expecting the Euro to depreciate or to appreciate with respect to the dollar? (underline the correct answer)

c. It turns out that on 10-19-2017 (spot), the $/£ is 1.316148 and the $/€ is 1.185122. Do you think that the forward rate was a good predictor of the direction of the change?

for the British Pound? YES NO

for the EURO? YES NO

5. Importer hedging on the spot or on the forward market

Suppose you are a U.S. bicycle dealer. You have signed a contract on September 29, 2017 in which you agree to import 1,000 bicycles from a British manufacturer and to pay £100,000 in a year from today. Use the Table mentioned above to find the spot and the forward (1 year) exchange rates and assume that the interest rate is the same on both currencies.

How exactly can you use the spot exchange market to protect yourself against the exchange rate risk?

How exactly can you use the forward exchange market to protect yourself against the exchange rate risk?

Which method would you recommend?