Assignment: Principles of Macroeconomics

Question 1. Consumption

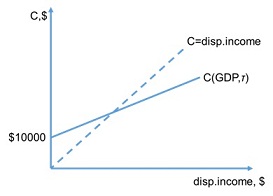

The Keynesian cross for a representative household is given in the figure below.

The marginal propensity to consume is 0.9. Tax rate is 35%. There is no depreciation or indirect taxes.

(a) How much does the household spend when it has no disposable income?

(b) How much does the household spend if its per capita GDP (the sum of wages and rent) is $55000? Does it break even (disposable income = C)?

(c) Suppose saving behavior is promoted among the population. What does the value of MPC have to become in order for a household to break even at the national income per capita of $55000?

Question 2. Spending multiplier.

The elements of expenditure are as follows:

Investment is I = 3500

Government spending is G = 5000

Net exports are NX = 0

Starvation-level consumption is s.l.c. = 4000

Furthermore,

Income tax rate is τ= 45%

GDP = 18000

The economy is in equilibrium.

(a) Find the value of autonomous spending.

(b) Find the value of the spending multiplier.

(c) What is the MPC in this country?

Question 3. Equilibrium in the Keynesian Cross

The elements of expenditure are fixed:

Investment is I = 3500

Government spending is G = 5000

Net exports are NX = 0

Starvation-level consumption is s.l.c. = 4000

Furthermore,

The spending multiplier is 1.6

and the output is GDP = 22000

(a) How do output and expenditure compare? What does that imply for the firms' inventories? Are they increasing, decreasing, or remaining the same?

(b) Illustrate with the Keynesian Cross how the economy will converge to equilibrium in the fixed-price environment if no government intervention happens.

(c) Suppose the government decides to offset the business cycle by increasing the public spending, G. Find by how much G has to increase in order to set the equilibrium at output=expenditure=22000.