Assignment: Markets in Action

1. (a) The price elasticity of demand measures the responsiveness of the quantity demanded /price to a change in the quantity demanded / the quantity supplied /price.

(b) Give the formula for own price elasticity of demand.

2. In the mid-1990s, the government in the US announced that for every 10 per cent rise in the price of cigarettes, the demand is likely to fall by 6 per cent. If this information is correct, what is the value of the price elasticity of demand for cigarettes?

3. In each of the following pairs, tick which of the two items is likely to have the more elastic demand. Give reasons for your answer.

(a) Gasoline (all brands) Shell gasoline

(b) Holidays abroad Bread

(c) Salt Clothing

4. The formula for price elasticity of demand is as follows:

Proportionate (or percentage) change in quantity demanded / Proportionate (or percentage) change in price

This can be summarised as (arc price elasticity - note that mid means average): (ΔQd / mid Qd) / (ΔP/mid P)

The following table shows the quantity of a product demanded at two different prices:

P Qd

16 25

14 35

(a) Calculate the proportionate change in quantity demanded when price falls from $16 to $14. (Use the first part of the formula, i.e. AQd / mid Qd , to do your calculation.)

(b) Calculate the proportionate change in price when price falls from $16 to $14. (Use the second part of the formula, i.e. AP /mid P, to do your calculation.)

(c) What is the price elasticity of demand between $16 and $14?

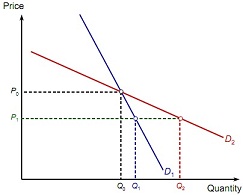

5. The following diagram shows two demand curves that cross at a price of Po.

Which of the following statements are true?

(a) Curve D1 is inelastic and curve D2 elastic. True /False

(b) Demand is more elastic between P0 and P1 along curve D2 than along curve D1 True /False

(c) The price elasticity of demand between P0 and P1 in the case of curve D2 is equal to:

{(Q2 - QO) / mid Q} / {(PO - P1) / mid P} ............................. True / False

(d) For any given change in price there will be a larger proportionate change in quantity along curve D1 than along curve D2. ....... True /False

6. Fill in the rest of the following table - keep in mind that mid means average:

(For the final column use the formula: (ΔQd / mid Qd) / (ΔP / mid P)

|

Quantity demanded (000s)

|

Price ($)

|

Total consumer expenditure

|

Elastic or inelastic demand

|

Price elasticity of demand

|

|

7

|

13

|

.......

|

|

|

|

9

|

11

|

.......

|

.......

|

.......

|

|

11

|

9

|

.......

|

.......

|

.......

|

|

13

|

7

|

.......

|

.......

|

.......

|

7. (a) What is the formula for income elasticity of demand?

(b) Which of the following would you expect to have a demand which is elastic with respect to income? (There are more than one.)

(i) Flour ...................................................................... Yes /No /Possibly

(i) Ready-prepared meals for the microwave ................... Yes /No /Possibly

(iii) Champagne ........................................................... Yes /No /Possibly

(iv) Socks ................................................................... Yes /No /Possibly

(v) Designer jeans ....................................................... Yes /No /Possibly

(vi) Electricity .............................................................. Yes /No /Possibly

(vii) Bus journeys ......................................................... Yes /No /Possibly

(viii) Insurance ..............................................................Yes /No /Possibly