Assignemnt

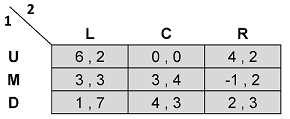

1. For the following game:

(i) Find the set of rationalizable strategies.

(ii) Find all pure and mixed-strategy Nash Equilibria.

2. Let us go back to the Cournot duopoly model where firms 1 and 2 select their production levels q1 and q2, respectively. So far, we have assumed that both firms have the same production cost. Let us relax this assumption in this exercise and consider an asymmetric Cournot duopoly game where the two firms have different production costs. Suppose the cost for firm 1 of producing q1 units is 2 • q1, while the cost for firm 2 of producing q2 units is 4 • q2. Suppose that the market price is given by p = 12 - q1 - q2. Answer the following:

(i) Write down the payoff functions u1(q1, q2) and u2(q1, q2).

(ii) Calculate the firms' best response functions BR1(q2) and BR2(q1).

(iii) Find the pure-strategy Nash equilibrium (q1*, q2*) in this game.

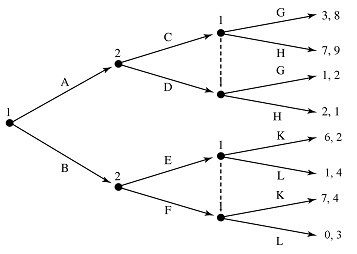

3. Take the following extensive game.

(i) Write the game in Normal Form.

(ii) Look for all Nash Equilibria (in pure and mixed-strategies).