PART I: Applying your understanding of the relationships among the financial statements:

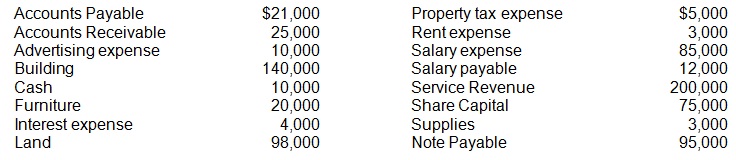

problem 1: The assets and liabilities of Toronto Service Inc. as of December 31, 2008, and revenue and expenses for the year ended December 31, 2008 are illustrated below:

Starting Retained Earnings were $50,000 and dividends totalled $50,000 for the year.

Required:

a) Prepare the Income Statement for the year ended December 31, 2008.

b) Prepare the Statement of Retained Earnings for the year.

c) Prepare the Balance Sheet at December 31, 2008.

d) Based on the financial statements prepared, answer the given problems:

• Was Toronto Service Inc. profitable throughout 2008? If so by how much?

• Did Retained Earnings increase or decrease? What is the amount of change?

• Which is the greater total, liabilities or total equity? Who owns more of the company’s assets, the creditors or the shareholders?

problem 2:

a) If you could pick a single source of cash for your business, what would it be? Why?

b) How can a business earn large profits however has a small balance in Retained Earnings?

c) How can a business lose money for many years and still have abundance cash?

d) Give two reasons why a business can be gainful for many years and still have a cash shortage?

e) Assume that your business has $80,000 worth of liabilities that should be paid within the next three months. Your liquid (can be turned into cash quickly) assets total only $60,000, your sales and collections from customers are slow. Identify two manners to finance the remaining $20,000 you will need, thus you can pay all of the liabilities when they are due.

PART II:

Janice Colangelo heads the Training Centre of the large HR Consulting firm EMT Consulting. The firm has three main departments: Recruitment, Training and Career Services.

The Training Centre gives management training for employees of different businesses. Recruitment gives recruitment services and Career Services assists personnel with resumes and offers advice on career planning.

The Training Centre employs 2 administrative assistants, 1 training officer and Janice, the manager on a permanent basis. Part-time trainers are hired on an as-needed basis. Part-time trainers are paid $1500 per workshop.

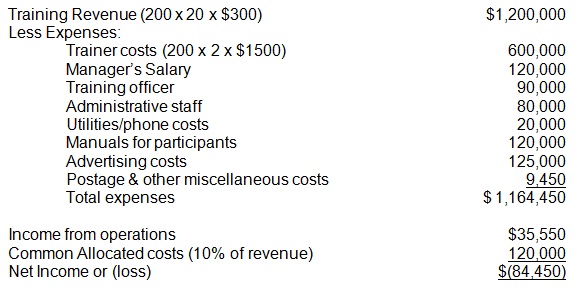

Throughout 2008 the Training Centre conduction 200 workshops with 20 individuals in each. The charge per individual was $300. This is the maximum number of workshops which can be held in a year.

Following are the results for 2008.

Required:

problem 1:

a) Classify each of the costs as variable or fixed.

b) What would be the consequence on the profit of the whole company, if the Training Centre was closed at the starting of the New Year?

Note: If the Training Centre is closed, one administrative staff will be retained to work in the Career Services department.

problem 2: Given the allocated costs at 10% of revenue, compute the number of workshops that must be offered to break-even.

problem 3: Re-compute the above, assuming Janice can re-negotiate the part-time trainer’s cost to $1000 per workshop.

problem 4: With the increase in globalization and companies outsourcing many jobs, Janice thinks that, in addition to management training, the Training Centre must offer ‘second career’ training. Janice feels that this will add 100 more workshops with an average enrollment of 15 participants at a cost of $200 each. The rate per participant is based on the fact that a non-profit organization has offered its facilities, free of charge, to run the workshops.

What effect will this have on the Training Centre profit?

Note: The trainers will be paid $1000 per workshop. The only other extra cost will be manuals at $15 each.