Advance Financial Analysis

Problem: 1

A company has on its books the following amounts and specific costs of each type of capital.

|

Type of Capital

|

Book Value

|

Market Value

|

Specific Cost (%)

|

|

Debt

Preference

Equity

Retained Earnings

|

400,000

100,000

600,000

200,000

1,300,000

|

380,000

110,000

900,000

300,000

1,690,000

|

5

8

15

13

|

Determine the weighted average cost of capital using:

a) Book value weights, and

b) Market value weights.

c) How are they different? Can you think of a situation where the weighted average cost of capital would be the same using either of the weights?

Problem: 2 From the following information extracted from the books of a manufacturing company, compute the operating cycle in days and the amount of working capital required (amounts are in $000):

Period Covered 365 days

Average period of credit allowed by suppliers 16 days

Average Total of Debtors Outstanding 480

Raw Material Consumption 4,400

Total Production Cost 10,000

Total Cost of Sales 10,500

Sales for the year 16,000

Value of Average Stock maintained:

Raw Material 320

Work-in-progress 350

Finished Goods 260

Problem 3: From the informations given below, you are required to prepare a projected balance sheet, profit and loss account and then an estimate of working capital requirements.

a) Issued share capital 5,00,000

6% debentures 2,50,000

Fixed Assets at cost 2,50,000

b) The expected ratios to selling price are:

Raw materials 45%

Labour 20%

Overheads 15%

Profit 20%

c) Raw materials are kept in store for an average of 1½ months

d) Finished goods remain in stock for an average period of 2 months.

e) Production during the previous year was 2,40,000 units and it is planned to maintain the rate in the current year also.

f) Each unit of production is expected to lag in process for half a month.

g) Credit allowed to customers is two months and given by suppliers is one month.

h) Selling price is Rs. 6 per unit.

i) There is a regular production and sales cycle.

j) (Calculation of debtors may be made at selling price.

Problem: 4

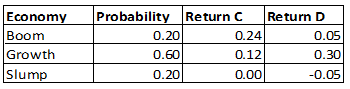

Suppose the shares of two companies: C and D, have the following returns and probability distributions:

a) find out the expected return and the expected risk for each security

b) find out the expected return and expected risk for a portfolio comprising 75%C and 25%D.

c) The extent of the benefits of portfolio diversification depends on the correlation between returns of securities. Briefly discuss the relationship between the portfolio risk and coefficient of correlation.