problem:

Mountain Hotels (MH) owns twenty hotels in Europe. The company specializes in hotels situated in hills and mountains so as to specialize in skiing holidays in the winter months and walkers outside this period. The hotels are comfortable but not luxurious.

AviemoreHeights (AH) was acquired two years ago to provide a presence in the UK. The hotel is an old, but well maintained property that has changed ownership several times over the years. It has always been positioned as a mid-price, good quality "destination" resort that is open during the skiing season. It opens on the first day of December and closes 120 days later as the weather conditions in the Cairngorms are unsuitable for skiing outside this period.. Each of the 50 rooms in the east wing rents for £75 for single occupancy or £100 for double occupancy. The west wing of the hotel has 30 rooms, all of which have spectacular views of the skiing slopes, the mountains, and the village. Rooms in this wing rent for £100 for single occupancy and £125 for double occupancy. The average occupancy rate based on both wings during the season is about 80% (typically, the AH is full on weekends and averages 50 to 60 rooms occupied on week day nights.) The ratio of single versus double occupancy is on average 2:8.AH does not have a restaurant or bar instead referring guests to the hotel across the road. However, AH does provide a continental breakfast, which is included in the room rate.

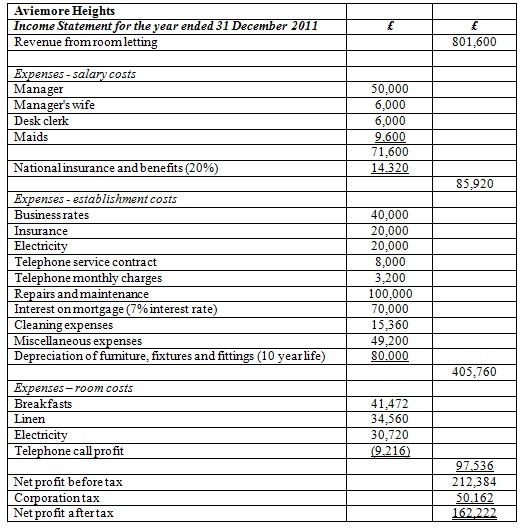

Operating results for the last fiscal year 2011 are shown in Table 1, MH is concerned about the performance of the hotel and believes that there is an opportunity to cater for walkers out of season as is the case with other hotels in the group.MH suggests to the manager,MrMcTavish, that to reduce the off-season losses, they should keep the west wing of the hotel operating year-round. After preliminary research, MrMcTavish estimates that the hotel could achieve an average occupancy rate for this wing in the off-season period of between 30% and 40% without promotion.MrMcTavishalso estimates that if the owners would commit £60,000 annually for an advertising campaign an occupancy rate for the 30 rooms of between 50% and 60% during the off-season would be guaranteed. There is no evidence to indicate that the 2:8 ratio of single versus doubles would be different during the off season or in the future. Rates, however, would have to be drastically reduced as the clientele would be principally walkers. Present plans are to reduce them to £45 and £70 for singles and doubles respectively.

The salary of the manager is £50,000 per annum. The manager acts as a caretaker of the facilities during the off-season and also contracts most of the repair and maintenance work during that time. Using the west wing would not interfere with this work, but would cause an estimated additional £40,000 per year for repair and maintenance work. Mrs. McTavish is paid £50 a day for preparing and delivering breakfasts, supervising the two maids and helping with check-ins. During the season, she works 7 days a week. The regular desk clerk and each maid, who also work 7 days a week during the season, are paid on a daily basis at the rate of £50 and £40 respectively. National insurance and benefits for Mr and MrsMcTavish and the staff average 20% of the payroll. Although depreciation and property taxes would not be affected by the decision to keep the west wing open, insurance would increase by £20,000 for the year. During the off-season, it is estimated that Mr. and Mrs.McTavish could handle the front desk and maid’s work without an additional person if occupancy was up to 30% but over this level and up to 50% a half-time maid would be required to service the rooms for seven days per week and at above an occupancy rate of50% a full-time maid would be required. Mrs. McTavish would continue to be paid for 7 days a week except for the period when agency staff were provided. An agency manager and deputy would be bought in for 50 days throughout the period to give Mr and MrsMcTavish a break at a cost of £400 per day. The cleaning supplies and half of the miscellaneous expenses (room supplies) are considered a direct function of the number of rooms occupied. The other half of the miscellaneous expenses are fixed and would not change with 12 month operation. Linen is rented from a supply house at an average cost of £2.50 per guest per day. Rooms must either be heated or air-conditioned. The electricity charge in the income statement reflects the annual expenditure on public spaces in the (lounge, entrance hall and corridors) and in preventing rooms suffering from damage through excessive cold or heat. With the full year operating, there is an additional electricity expense based on room occupancy and estimated at £4 per day irrespective of whether there is single or double occupancy. The telephone system is supplied by a private exchange company. Apart from the annual service agreement there is a monthly rental cost for each active phone of £10. If a wing is open a phone will need to be active in each room, thus, in the season with 80 rooms active the bill is £800 per month. Each phone on average makes a profit £1.20 per day irrespective of whether the room is double or single occupancy. The cost of the continental breakfast cost is £3 per guest.

problem: required

Produce a REPORT for MH that addresses the following issues:

1) find out the contribution per occupied single room and per occupied double room and the breakeven occupancy % of the off -season proposal without advertising.

2) Advise the Mountain Hotels on whether the proposal of promotional expenditure to raise the occupancy rate is worthwhile and the break-even occupancy rate for this alternative proposal.