Case Abstract

A regional producer of soft drinks must decide whether to continue in the bottled water market. Four options are considered. Side issues include the value of an attractive financing package surrounding a possible acquisition and brand name as a barrier to entry into a market.

Introduction

Punch Products (PP) is a regional producer of soft drinks and sells mainly in the states of Kansas, Oklahoma, and Texas. Three years ago, in 2009, it made the decision to diversify into the bottled water industry, whose market enjoys a good reputation in a health-conscious America and is especially popular in areas where the quality of municipally provided water is suspect. Firms cater to businesses and homes, obtaining income mainly from the delivery of bottled water and the rental of water coolers. The market PP entered has one highly successful firm, Clear Springs, which is family owned with yearly sales of about $6M. The next largest firm is Well Water and there are ten extremely small firms with one or two trucks, six of which have appeared in the last two years.

When the decision was made to produce bottled water, nearly all of PP's executives were extremely confident that the venture would be highly profitable. This optimism was based on (1) projections showing the bottled water market was growing; (2) cost estimates implying that PP could undersell its competitors by 10 percent; and (3) PP's ability to pick winners in the soft drink market. Unfortunately, there was a barrier to entry that few realized: firms were not buying a product so much as a service and the marketing strategies of mass advertising (newspaper, radio, TV, etc.) and price discounts simply did not work. Mass advertising was ineffective because consumers believed correctly that all bottled water was really the same thing. Therefore, it is hard for a firm to differentiate its product, unlike firms in the soft drink industry. Price discounts failed for two reasons. First, a firm's managers were not especially attracted by price discounts. More important, firms were not buying a product but a service-a visit and chat with the delivery person. All in all, it was hard to convince firms to switch bottled water firms. As one manager put it: "So we save a few bucks." But that means we won't see Dave every week. And-my goodness - Dave's like family! It wouldn't be right to switch."

The Current Situation

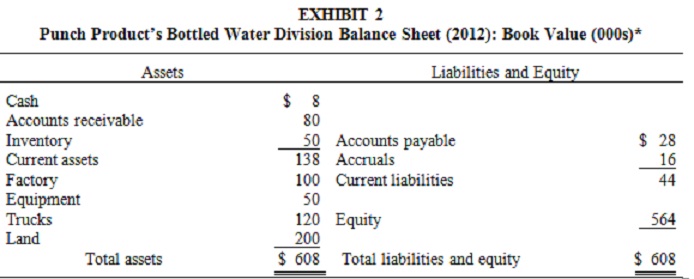

At this point, PP's bottled water business has shown operating losses of nearly $300(000), which does not include the initial investment of more than $800(000). Management is now taking a critical look at the decision made nearly three years ago and must decide between one of four options. It can (1) continue as is; (2) abandon the project completely; (3) stop producing bottled water but retain ownership of the land and lease the building; or (4) go after the bottled water market by acquiring Well Water. The "as is" alternative does not require any additional expenditure and is expected to generate the situation shown in Exhibit 1. No one finds this option especially appealing. Management's thinking is, "If we stay in the market, let's do it right or give the project its pink slip."

EXHIBIT 1

Pro Forma "As Is" Income Statement for Punch Product's Bottled Water Division

(000s)*

Sales $ 800

Cost of goods sold 200

Gross margin 600

General administrative expenses 150

Selling expenses 290

Miscellaneous fixed expenses 10

Depreciation expense 100

EBIT 50

Taxes (40%) 20

Net income $30

*Management feels this situation could persist indefinitely

Abandoning the project has at least one vocal supporter, Clifton Millard, a plant manager, who argues that this strategy will give PP immediate benefit. The land that PP paid $200(000) for ten years ago has a market value of $380(000) and is not presently needed. The factory would, of course, be sold with the land and is worth about $90(000). He admits that the trucks PP purchased have relatively little market value since they are highly specialized; that is, they were built to carry the 5-gallon jars of water and are not especially suitable for other purposes. A reasonable estimate is that they could be sold for 50 percent of their book value. The remaining equipment can also be sold at 50 percent of book. The receivables are generally of good quality and PP should obtain $72(000) when they are collected. "And, of course," notes Millard, "we could liquidate at 100 percent of book, our inventory of bottled water."Stan Covington, the firm's president, also favors abandoning the project, though his proposal is not quite as drastic Millard's. He suggests keeping the land and renting the building, though the trucks and equipment would be sold, the receivables collected, and the inventory liquidated. Leasing the building would be a simple matter and would net $40(000) a year; a figure that includes all yearly expenses but not taxes. He agrees with Millard that the land is not needed by PP now, but in three to five years it might be since PP's soft drink sales have been growing and it is very likely that the firm will need additional area for expansion. The location of the current bottled water plant is considered ideal for growth. "At a minimum," argues Covington, "if we keep the land it can always be sold in the future. The current market value is nearly 100 percent more than we paid for it and should continue to appreciate this way." He also points out that the factories could be used for the production of soft drinks.

*The net working capital situation assumes annual sales are $800(000).

Well Water

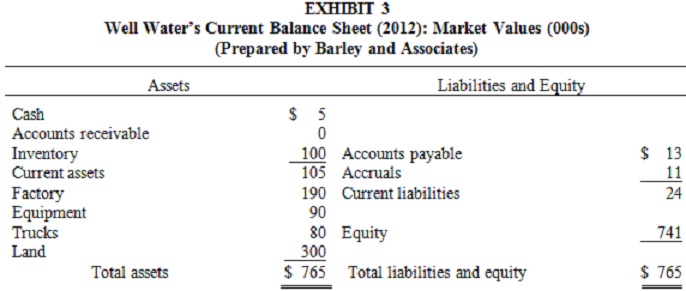

Well Water has been in business nearly 100 years, has always been owned by the Gerry family, and is the second largest bottled water firm in the area in terms of annual sales. To help evaluate the feasibility of acquiring Well Water, PP hired Barley and Associates, a respected consulting firm, which has a bit of a national reputation. The first step in the acquisition process was to accurately determine Well Water's most recent income statement. Unbelievably, this was a very difficult and time-consuming task because the current owner, Scott Gerry, simply never appreciated or liked the idea of keeping accurate records. All sales were made in cash and then deposited. In order to estimate last year's sales, Barley and Associates had to examine deposit records, being careful not to count cash resulting from the sale of assets like machinery and water coolers. Expenses were estimated using canceled checks and an on-site verification of Well Water's assets was made (Exhibit 3 - Balance Sheet; Exhibit 4 - Income Statements; Exhibit 5 - excerpts from the report of Barley and Associates).

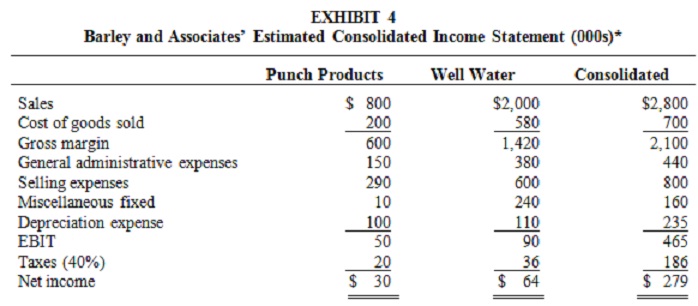

*The figures on PP are the projection of its "as is" position and those on Well Water represent Barley's estimate of Well Water's situation for the previous year. All estimates assume a reasonable working capital policy.

EXHIBIT 5

Excerpts of Barley and Associates' Study on Well Water

- Enclosed you will find our estimate of Well Water's most recent income statement and its current balance sheet. Please note that the asset values are estimated market values.

- There is little doubt that Well Water has been poorly run. Here are a few exs: failure to require a deposit on the water coolers has resulted in the firm absorbing the full cost of all breakage on the part of the customers; what it would cost to buy them new. The same is true of its leased computer. Our consolidated income statement assumes you discontinue leasing and purchase this equipment at an estimated cost of $100(000).

- Consolidation will most definitely reduce costs. Distribution will be more efficient and more effective use will be made of plant, equipment, and trucks.

- See our estimate of a consolidated income statement in Exhibit 4. The Punch Product numbers are the figures you supplied us. The Well Water numbers represent our estimate of this firm's most recent income statement. It is our opinion that the consolidated figures could persist indefinitely, assuming reasonable service of Well Water's present customers and a reasonable credit policy.

- Well Water has no receivables because all sales were in cash. This undoubtedly has hurt sales. Its abnormally low amount of accounts payable and accruals reflects it policy of paying its suppliers very promptly and its employees once a week. We judge your net working capital situation (CA-CL) to be typical of a firm in this industry.

PP's executives feel quite confident that these estimates are accurate and are pleased with the thoroughness of Barley and Associates. PP is also confident that the bottled water market is expanding. The area's economy is projected to grow sharply in the next five years and this means more firms to serve (and households as well should PP decide to enter that market). Then there is the result of a survey done by Liz London, the director of marketing. At the end of each business day for three full months, London faithfully queried the cooler installation man at Well Water and determined that based on the number of new coolers they installed, Well Water's sales should have doubled. The problem, London was astonished to learn, was that they removed as many old coolers as they installed. The service of Well Water was the major problem. Apparently some new orders were never processed, others were processed literally months after they were initially placed, and missed deliveries were common.

"Refresh my mind," Millard says, somewhat sarcastically. "Exactly why are we interested in buying this firm? Certainly not for its bookkeeping system or its management policies. And certainly not for its assets. I mean, the market value of all it owns is only about $800(000) and we're considering paying $2M for the firm. It all sounds crazy to me. The difference of $1.2M represents goodwill, which we can't ever depreciate."

Lindy Garter, CFO, then proceeds to address this problem at some length:

Our original idea that the industry is growing wasn't wrong, only our ideas about marketing the product. Believe it or not, we're buying Well Water's name and loyal customers. It has been around for nearly a century and only recently has it gone downhill. Acquiring Well Water will give us a foothold in the market.

We know how to deliver a product and provide quality service. I believe that Well Water has been a victim of its inability to serve all its new customers of the last few years. If you think about it, you'll notice that based on Liz's research, Well Water apparently had new sales of well over $2M in the last two years. How much new business did we get during the same period with our heavy advertising and lower prices? About $800(000), that's all! And keep in mind the area's expansion will bring in new business and may well strain local water supplies and cause a reduction in water quality.

London agrees that Millard has raised a good problem but tends to side with Garter. "We can't look at what Well Water is," she says, "We have to look at what it can be." She also points out that the acquisition contains an attractive financing package. Gerry wants $2M for Well Water but only $1M up front. Gerry would finance the remainder with a 7-percent, 5-year loan, though the current market rate of interest on this type of debt is 12 percent. The terms of the loan allow PP to pay only the interest each year and the entire principal can be deferred for five years; that is, a balloon payment of $1M would be due in five years.

At this point, discussion returns to other issues in the investigation of Barley and Associates. Their report indicates that a consolidation of the firms will result in an increase in profitability even if there is no change in the sales of each firm from the acquisition (Exhibits 4 and 5). The report also suggests one reason that the firm has been losing customers. Well Water's delivery people were actually responsible for loading their own trucks. Many would frequently not begin deliveries until 11 or 11:30 in the morning and exhausted at that. The result was that many customers were not serviced or received late deliveries. A consolidation would easily correct this. Idle equipment of PP's could be moved to Well Water's plant to automate the loading. Only one night shift operator-loader need be hired and the trucks could be ready to go by 8:00 a.m. (Note: The cost of this extra person has already been considered in Exhibit 4.)

It also is obvious to PP's management that the actual cost of Well Water could differ and perhaps substantially, from the asking price of $2M. There is, of course, the attractive financing arrangements surrounding the purchase. On the other hand, it is clear the Well Water's (net) working capital policy has hurt sales and this will require funding to change. In addition, PP will need $100(000) to buy equipment that Well Water is currently leasing.

After further discussion a consensus is reached on a number of issues relevant to the choice.

1. The projections shown in Exhibit 1 should continue indefinitely.

2. The consolidated pro forma income statement in Exhibit 4 is quite reasonable; the net income projection is relatively low risk because it depends mainly on the merger, which management believes would easily bring about greater efficiency.

3. If Well Water is acquired, annual sales could easily reach $4M during Year 3 and might top $5M in four to five years.

4. Cost of goods sold will be 25 percent of sales; selling expenses will change by 20 percent of sales exceeding $2.8M; and general and administrative and miscellaneous fixed expenses will both change by 5 percent of sales exceeding $2.8M.

5. PP's current net working capital situation is reasonable.

6. The appropriate tax rate is 40 percent.

7. The acquisition would enable PP to handle annual sales of $5M to $6M without any increase in fixed assets.

8. Any lease would last five years and could be renewed indefinitely.

9. The yearly cash flow with each option will equal EBIT adjusted for taxes less any change in working capital requirements. (Any cash flow resulting from depreciation is assumed to be used to maintain existing equipment.)

A final problem involves the appropriate discount rate. The lease option is considered a lower risk than either the "as is" or acquisition options. The yearly cash flows from the "as is" option should be discounted at 13 percent and those from the lease at 10 percent. With the acquisition alternative, management has identified three distinct cash flow streams. Management will use a 13 percent rate on the cash flow generated by sales of $2.8M or less. It feels 16 percent is the appropriate cost of capital (required return) for the incremental cash flow on sales between $2.8M and $4M. Finally, a 22 percent rate will be used on the incremental cash flow generated by sales above $4M. (Note: All rates are on an after-tax basis.)

problems:

1. How relevant to the decision are the $800(000) initial cost of the project and the operating losses of $300(000)?

2. (a) find out the incremental liquidation cash flows for the abandon completely alternative. (Be sure to consider the tax effects from the sale of the land, trucks, equipment, and factory. Use the cash flows from the "as is" option as the base position to find out these incremental amounts.)

(b) What would the incremental liquidation cash flows be from the abandon-but-lease alternative? (Use the "as is" option as the base position.)

(c) find out the NPV for each of these options.

(d) Based on these calculations and other information in the case, are these alternatives superior to the "as is" position? Which of the two is more consistent with the objective of value maximization? describe.

3. What will be the cost of Well Water after considering the financing surrounding the purchase (savings on the loan), Well Water's (net) working capital situation, and the additional equipment that would be purchased?

4. Barley and Associates estimated that net income after the merger will exceed the sum of the net incomes both firms achieved individually. Does this seem reasonable? describe.

5. (a) Develop pro forma (consolidated) income statements for annual sales of $4M and $5M.

(b) find out the relevant incremental cash flows. (Use the "as is" cash flows as the base position to find out these incremental amounts.)

(c) What is your estimate of Well Water's value? describe.

6. Does it make sense for PP's management to use so many discount rates in its evaluation? describe.

7. What additional information would you like to have to make a more informed decision?

8. Based on your previous answers, any other calculations you feel are relevant, and information provided in the case, which alternative do you recommend? Fully support your position.

9. Problem(s)

Discuss the problem(s) you are asked to solve, analyze, discuss, and make a decision concerning

10. Solution(s)

Discuss the solutions or options to solve the problem(s), present at least three (3) solutions. There may be more than three

11. Optimal Solution

Present the best (optimal) solution with supporting evidence for the problem(s)

12. Conclusion(s) and/or Recommendation(s)

Present a final conclusion or recommendations if any. (Defend your conclusions and or recommendation.