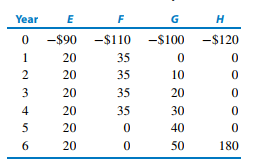

(a) Based on future worth analysis, which of the four alternatives is preferred at 6% interest?

(b) Based on future worth analysis, which alternative is preferred at 15% interest?

(c) Based on the payback period, which alternative is preferred?

(d) At 7% interest, what is the benefit-cost ratio for Alt. G?