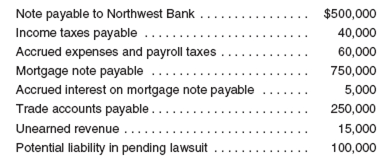

1. The following are selected items from the accounting records of Seattle Chocolates for the year ended December 31, 2011:

(K) Other Information

1. The note payable to Northwest Bank is due in 60 days. Arrangements have been made to renew this note for an additional 12 months.

2. The mortgage requires payments of $6,000 per month. An amortization table shows that its balance will be paid down to $739,000 by December 31, 2012.

3. Accrued interest on the mortgage note payable is paid monthly. The next payment is due near the end of the first week in January 2012.

4. Seattle Chocolates has been sued for $100,000 in a contract dispute. It is not possible at this time, however, to make a reasonable estimate of the possible loss, if any, that the company may have sustained (We have not covered this yet. However, this is not yet a liability that the company can demonstrate in its balance sheet. Just ignore this 100,000 that is also shown in the above table when you answer the following questions).

Instructions

a. Using the information provided, prepare the current and long-term liability sections of the company's balance sheet dated December 31, 2011. (Within each classification, items may be listed in any order.)

b. Explain briefly how the information in each of the four numbered paragraphs above influenced your presentation of the company's liabilities.

2. During the fiscal year ended December 31, Swanlee Corporation engaged in the following transactions involving notes payable:

July. 1 Borrowed $20,000 from Weston Bank, signing a 90-day, 12 percent note payable.

Sep.16 Purchased office equipment from Moontime Equipment. The invoice amount was $30,000, and Moontime agreed to accept, as full payment, a 10 percent, three-month note for the invoice amount.

Oct. 1 Paid Weston Bank the note plus accrued interest.

Dec. 1 Borrowed $100,000 from Jean Will, a major corporate stockholder. The corporation issued Will a $100,000, 9 percent, 120-day note payable.

Dec. 1 Purchased merchandise inventory in the amount of $10,000 from Listen Corporation. Listen accepted a 90-day, 12 percent note as a full settlement of the purchase. Swanlee Corporation uses a perpetual inventory system.

Dec. 16 The $30,000 note payable to Moontime Equipment matured today. Swanlee paid the accrued interest on this note and issued a new 60-day, 16 percent note payable in the amount of $30,000 to replace the note that matured.

Instructions

a. Prepare journal entries (in general journal form) to record the above transactions. Use a 360-day year in making the interest calculations.

b. Prepare the adjusting entry needed at December 31, prior to closing the accounts. Use one entry for all three notes (round to the nearest dollar).

c. Provide a possible explanation why the new 60-day note payable to Moontime Equipment pays 16 percent interest instead of the 10 percent rate charged on the September 16 note.

3. On October 1, 2011, Walla signed a 4-year, $100,000 note payable to Vicksburg National Bank in conjunction with the purchase of equipment. The note calls for interest at an annual rate of 12 percent (1 percent per month), and monthly installment payment of $2,633. The note is fully amortizing over a period of 48 months.

a. Prepare an amortization table showing the allocation of monthly payments between interest and principal over the life of the loan (Refer toExhibit 10.5 for the format of the table). Amortization table must be prepared in Excel. There may be some amount still outstanding at the end of the installment period due to decimal points.

b. Prepare journal entries to record the first five monthly payments on this note and the initial borrowing.