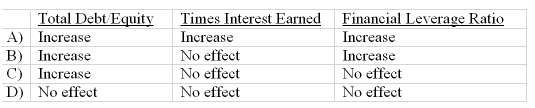

1. If a company issues a 1% stock dividend what is the effect on the following ratios, all other things being equal?

Option A

Option B

Option C

Option D

2. The short-term liquidity of a company

is only of concern to creditors of a company

is determinable by looking at current ratio

depends largely upon prospective cash flows

is determinable by calculating cash to current liabilities ratio

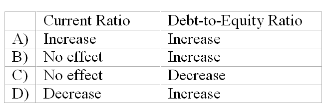

3. If a firm capitalizes a lease instead of treating the lease as an operating lease, the effect on the current ratio and the debt-to-equity ratio will be to:

nb

Option A

Option B

Option C

Option D

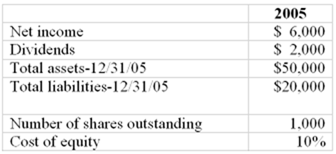

4. Hupta Corporation

Net income is expected to increase by 10% for the next year, and dividend payout ratio is expected to remain constant. After 2006, residual earnings are expected to decrease to zero. Using the earnings-based valuation method what is the value per share of Hupta stock as of 12/31/05?

$33.60

$33.27

$32.73

$30.00

5. Which of the following is not a factor in producing earnings forecasts?

Estimating the level of earnings

Separation of recurring and nonrecurring components

Recognizing potential earnings management

Recognizing potential income smoothing

6. Which of the following should be attempted in order to gauge the quality of a company's earnings?

I. Assess adequacy of discretionary expenditures

II. Assessing degree of conservatism in reporting assets

III. Assessing degree of conservatism in reporting liabilities

IV. Assessing degree of conservatism in application of accounting principles

I, II, III and IV

I, II and IV

II, III and IV

I, III and IV

7. Which of the following transactions or events would have no immediate effect on the times interest earned ratio but will cause debt/equity ratio to decrease?

issuing new debt

issuing new equity

having a stock split

recording large contingent liability for lawsuit

8. ABC company is planning a major expansion for which it needs $5 million in external funding. It has various options as how to finance this expansion. Which of the following is correct?

Future ROA will be higher if it uses all equity financing than if it uses some debt financing

Future net income will be higher if it uses common stock rather than preferred stock to finance expansion

Future ROA is independent of the form of financing

Future net income is independent of the form of financing

9. A growing company with disappointing profitability would generally have

High price/book and high price/earnings

High price/book and low price/earnings

Low price/book and high price/earnings

Low price/book and low price/earnings

10. Which of the following statements are true?

I. Pre-tax cost of debt is generally higher than the pre-tax cost of equity

II. Interest is tax deductible

III. Preferred dividends are tax deductible

IV. Total cost of capital is normally less than or equal to cost of equity

II and IV

II, III and IV

I, II and IV

II only