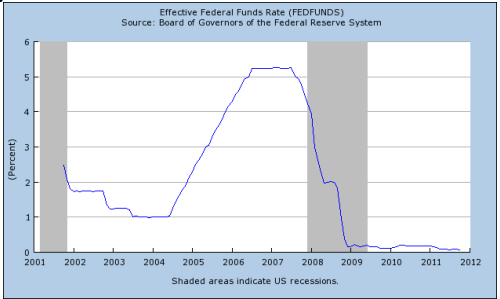

1. During the early part of the previous decade, the Federal Funds Rate was quite low. This is an indication that the Fed was trying to expand the money supply. Using your understanding of monetary policy, explain what the Fed was attempting to do to the economy.

Unfortunately for the Fed (and the economy), it appears that the Fed's actions during this period may have contributed to the recent recession. Explain how the Fed's action may have contributed to the recent recession.

Explain why the Fed cannot more precisely control the economy through its manipulation of the money supply.

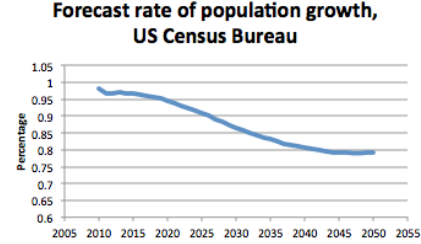

2. Politicians often make the case that they want policies that will make the economy grow more rapidly. Explain what factors control the rate of growth for the economy over long periods of time.

Now consider two special cases of economic growth. First, the baby boomer generation is just now beginning to retire. What implications is this likely to have for the long term rate of growth of the economy? Why?

Second, the government establishes policies for immigration. How do these policies play into driving the longer term rate of growth for the economy (if at all)? Fully explain your answer.

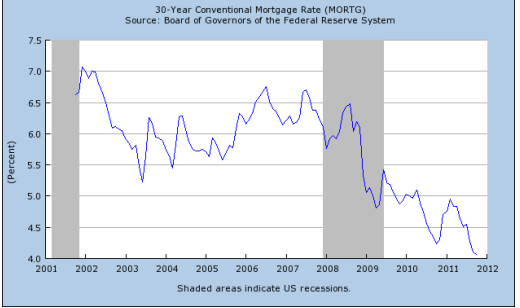

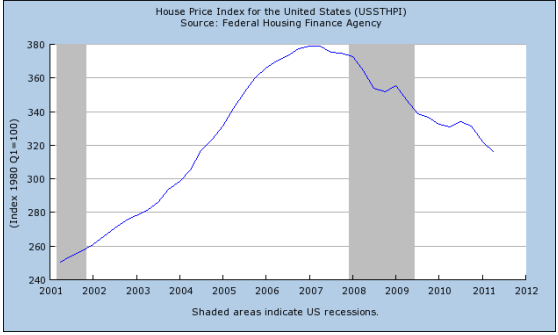

3. The recent recession was caused by a boom-bust cycle in the housing market. Explain the sources of the real estate boom-bust cycle in the United States.

To correct the consequences of this recession, the federal government has pursued a policy of extensive intervention in the economy. Despite the size of the intervention, the economy seems to be recovering only at a very slow pace. What reasons likely lie behind the slow pace of the recovery?

4. The rapid pace of growth of government spending in recent years has markedly increased the national debt. This has generated many calls for a reduction in government spending. What are the short-term and long-term arguments for and against a near term change in government actions?