Magnusson Electrics had been a distributor of electrical goods for almost 70 years, supplying different industries including the auto industry in Michigan. Magnusson family had run business for 70 years, beginning with founder Mike “Electric” Magnusson an MIT engineer and pioneering entrepreneur.

For several reasons including family feuding, foreign competition, and poor management not modernizing its distribution and logistics methods firm lost its edge and the quality of its products and services became uncertain. It gradually became unprofitable, started to have cash flow problems, and by 2011, the firm was forced to declare bankruptcy.

Firm had five distribution facilities but EPA declared one of its facilities to be contaminated. Forced to pay the large amount of money into a clean up fund the company had to face reality which it was no longer capable of operating without fresh infusions of capital and management. Magnusson family hired search firm to find a buyer for the firm and after a six month search a potential buyer materialized. Firm of Fairfield General Holdings (FGH), a holding company in the distribution and logistics industry asked to see Magnusson’s balance sheet.

MAGNUSSON’S CURRENT FINANCIAL CONDITION

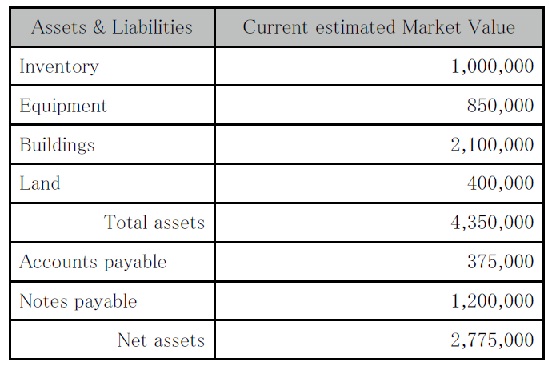

Here are the present book and market values of Magnusson’s assets and liabilities. The only assets of interest to buyers are its tangible (physical assets) that are listed below. Value of the contaminated facility and land it was built on is zero and it is not included in the assets below. There is no cash or accounts receivable because these were used by bankruptcy court to pay off part of the claims of Magnusson’s creditors (mainly taxes, employee wages and pension arrears, and some suppliers). Against these assets are claims of suppliers and a bank loan used to finance a portion of inventory. FGH hired the valuation consultant for Magnusson’s tangible assets and liabilities. Here are consultant’s conclusions.

FGH’s business analysts computed a value of $$3,025,000 for Magnusson’s net assets including $250,000 of goodwill and accordingly, on June 1st, 2011 FGH made the offer that was accepted.

FGH’s plan is to inject cash and business expertise into firm: upgrading buildings, utilizing robots in its facilities, outsourcing the transportation function to the specialist transportation company, seek the larger number of products to distribute both in USA and abroad, and introducing modern methods of distribution and supplier management.

FGH estimates that after all upgrades are completed, firm would have total assets of $12,000,000, which it would be able to carry 10 times inventory it carries at present, and be able to attain inventory turnover ratios of 6 at gross profit margins of 50%.

So average inventory carried cost could be estimated as $1,000,000 x 10 = $10,000,000. Future annual cost of goods sold could be estimated as $1,000,000 x 10 x 6 = $60,000,000 and the future annual sales could be computed as $1,000,000 x 10 x 6 x 2 = $120,000,000. An estimated NPM of 10% results in projected net income of $12,000,000.

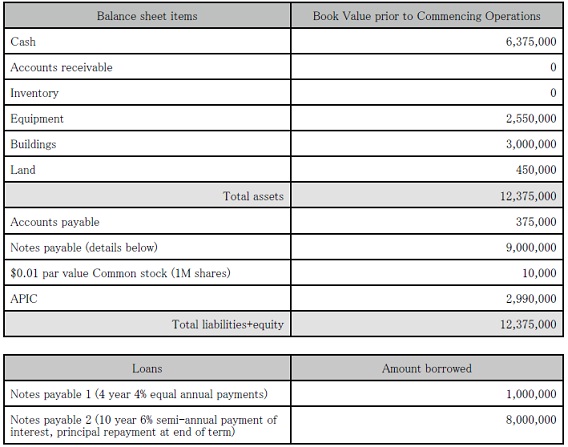

To execute its business plan, FGH created a corporation - Fairfield-Magnusson - to act as operating company. F-M issued 1,000,000 shares of $0.01 par all of that were purchased by Fairfield General Holdings paying FM $3,000,000 for those shares.

On July 1st, 2011, F-M borrowed $8,000,000 on a 10 year 3% note with interest payable every six months and the face value due at the end of the 10 years. It then paid cash of $3,025,000 for all of Magnusson’s physical assets and debts and began the upgrade process.

During this initial startup period, F-M also renegotiated the rate on the 6% 3 year $1,200,000 loan down to 4% and extended its term to 4 years with interest and principal payable in 4 year-end equal payments).

Fairfield-Magnusson’s balance sheet as of September 1st, at the end of loan negotiations and the upgrades of its facilities and the implementation of the new inventory policy is shown below. Suppose that both the loans began as of Sept 1st [so no interest needs to be find outd during the startup period from June 1st to Sep 1st].

Fairfield-Magnusson’s Operations for the rest of the year

More favorable property tax rates were negotiated with the townships in which three remaining facilities were located and the employees agreed to a slight wage reduction and a three year freeze. On Sept 1st, 2011 the firm reopened for business as Fairfield-Magnusson. Here are the summary transactions for the remaining 4 months of the year.

Transaction list

1. The firm paid off all existing accounts payable to the suppliers as per the bankruptcy agreement.

2. It paid $130,000 on two day vacation for its most significant suppliers.

3. To consolidate its initial operations and reduce operating costs, F-M closed two of its four distribution facilities. It sold one facility valued on the books for $540,000 cash and moth-balled another. The book values of the land, equipment, and buildings of the facility that was sold were $10,000, $200,000, and $350,000 respectively.

4. To announce its rebirth as Fairfield-Magnusson, the firm spent $100,000 contacting former customers and letting them know of its comeback and soliciting their business.

5. Gross purchases of inventory totaled $11,230,000. Purchase returns were $25,000. The firm was conscientious about taking cash

payment discounts and took $120,845 in cash discounts. At year-end the firm had remaining accounts payable of $1,480,000. Transportation-in costs, all paid in cash, were $130,000 [hint: you can find out cash paid to suppliers for inventory purchases from this information.]

6. All sales are on credit. Sold inventory for $18,500,000 at a gross profit margin of 50%. The firm uses average costing for inventory and keeps perpetual records but instead of keeping track of each item’s cost, the firm records cost of goods sold of 50% of revenues for each sale. Thus, the cost of goods recorded for each sale during the year is an estimated amount, not the actual cost of the individual item sold. This saves the firm the cost of keeping detailed records but also permits it to create periodic interim reports.

At the end of the year, a physical inventory count is taken and the inventory valued. The inventory account is then written down or up (with the cost of goods sold being the other journal entry line) so that the inventory account’s year-end balance matches the count and valuation of the actual physical inventory.

7. Sales returns for the period were $250,000 and total cash discounts given were $300,060.

8. The firm paid $165,000 for electricity, telephone, and other administrative and office expenses.

9. Paid $1,839,750 for salaries and wages of general operations and administration together with all the payroll taxes (FICA) and various other payroll related costs.

10. Advertising and other selling costs of $600,000 were incurred and paid during the period. Salaries, wages, and other payroll costs for the sales function was $1,010,250.

11. Paid transportation-out costs for the period were $750,000.

12.The uncollected accounts receivable at the end of the year was $2,325,000. [hint: you can now find out the cash collected from accounts receivable with this information.]

13.The firm purchased insurance and prepaid some other expenses to the amount of $230,000.

14. Total of property taxes assessed by all jurisdictions where facilities are located is $32,000 of which $2,000 remained to be paid at year-end.

15.The firm collected a $15,000 surety deposit for a special order for submersible electrical motors.

16. The corporate income tax rate is 35%. Information collected for making adjusting entries After looking through the books and various financial records the controller has collected the following information for making adjusting entries.

1. The percentage of ending receivables estimated to be uncollectible is 1%.

2. The valuation of the physical inventory found that the ending inventory balance needed to be $1,450,500.

3. Payroll expenses incurred but not paid as of Dec 31st. was $50,000. This amount is not included in the $1,839,750 amount mentioned in paragraph 9 in the transactions listing.

4. Fulfilled $10,000 of special order for submersible motors described in paragraph 15 in the transactions listing.

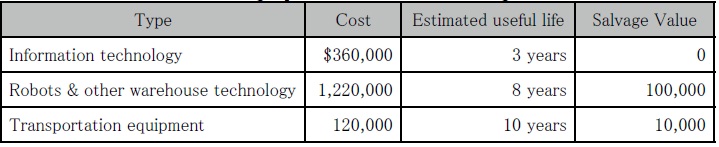

5. Firm uses straight line depreciation. Cost of the original Magnusson equipment ($850,000) is computed as having an useful life of 5 years and salvage value of zero. Newer equipment purchased by F-M ($2,550,000 - 850,000) is being depreciated over various lifetimes given below.

6. Cost of the original Magnusson Buildings ($2,100,000) is to be depreciated over 25 years with a salvage value of $100,000. The several improvements made by F-M ($900,000) are being depreciated over 15 years with a salvage value of zero.

7. At the end of the year, firm had used $63,525 of the $230,000 prepaid for insurance and other expenses.

Required

(a) Present year-end financial statements - the balance sheet, the income statement, the statement of changes in equity and the cash flow statement. On the income statemen tmake sure to separate cost of goods sold, general and administrative expenses, selling expenses, financial revenues or expenses, and incidental gains and losses (from selling of equipment for ex). In other words, income statement must look like this:

Revenue $ 100

less: cost of goods sold 40

gross profit 60

General and Admin exp -10

Selling expenses -20

income from operations 30

Financial revenues & expenses -5

Incidental gains and losses 3 << incidental gain

Income before taxes 28

Provision for income tax 9.8

Net income 18.2

Round off all numbers to the nearest dollar - so no decimal points in your financial statements.

(b) If you are a bank loan officer in charge of Fairfield-Magnussion’s loans what characteristics and measures will you use to evaluate F-M? Present a short discussion of your conclusions. In your discussion, suggest what may be the maximum amount of unsecured long-term (5 years or more) loan you will recommend that bank lend?

(c) If you are Fairfield General Holdings’ business analyst what characteristics of F-M will you measure and what conclusions will you draw? Present a short discussion of your conclusions and recommendations.

(d) If you are F-M’s CEO - prepare the short report as to what will you present to your only shareholder (FGH) regarding whether F-M is on track to attain FGH’s business plan. In particular, discuss F-M’s cash flows and whether operating cash flow could be used be for future expansion.